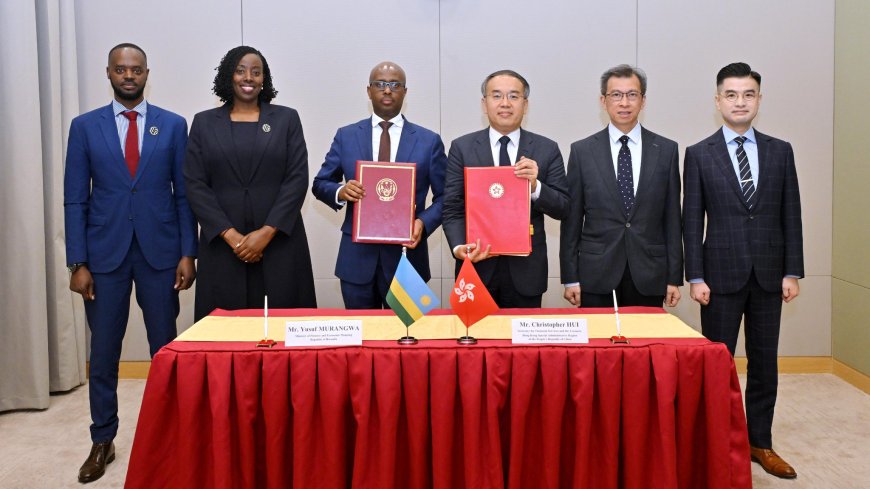

Rwanda and Hong Kong Strengthen Ties Through Double Taxation Avoidance Agreement

Rwanda and Hong Kong have signed a Double Taxation Avoidance Agreement (DTAA), aimed at eliminating the issue of double taxation for investors operating in both jurisdictions. The agreement is expected to ease cross-border investments and promote economic cooperation in key sectors.

Under the new deal, investors will no longer be taxed twice once in their home country and again in the host country thereby reducing barriers to doing business and enhancing financial efficiency. This measure is set to significantly benefit investors from both Rwanda and Hong Kong by fostering a more favorable business environment.

Beyond simplifying trade, the agreement will deepen collaboration between the two economies in sectors such as:

- Financial services

- Manufacturing

- Technology

- Health

- Logistics

- Education

Through this partnership, Rwanda stands to attract more investment from leading Hong Kong-based companies, particularly in technology and industrial development, while also expanding opportunities for Rwandan enterprises.

Hong Kong, known as a global financial and trade hub, already serves as a key source of industrial and technological goods for Rwandan businesses. The new tax treaty is expected to further strengthen economic relations and boost investor confidence in Rwanda and the wider region, contributing to sustainable economic growth.

Kinyarwanda

Kinyarwanda

English

English

Swahili

Swahili