Government Sets Goal: Merging SACCOs into Districts and Establishing a Cooperative Bank

The Government of Rwanda is pushing forward an ambitious plan to improve the management of community savings and credit cooperatives by fully digitizing all Umurenge SACCOs and merging them at the district level. This effort will pave the way for a Cooperative Bank that will unite them all, helping to solve issues of poor management and unpaid loans.

On July 8, 2025, the Minister of Finance and Economic Planning, Yusuf Murangwa, announced that all 416 Umurenge SACCOs have been digitized, and the program to consolidate them into District SACCOs is steadily progressing across the country.

So far, seven districts have successfully established District SACCOs namely Nyarugenge, Gasabo, Kicukiro, Gicumbi, Rubavu, Rwamagana, and Nyamagabe. This consolidation aims to address recurring challenges within SACCOs, such as unpaid loans, weak governance, and the lack of robust oversight over how members’ savings are managed.

“Today, all Umurenge SACCOs have been digitized. The next step is to merge them at the district level so we can create a Cooperative Bank that will connect them nationwide,” Minister Murangwa said as he explained the progress made.

He emphasized that this Cooperative Bank will offer improved, more affordable financial services and help communities access reliable banking, whether they live in rural or urban areas.

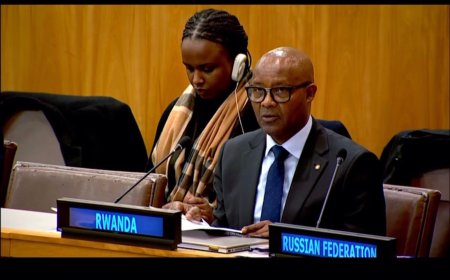

The Minister of Finance and Economic Planning Yusuf Murangwa

The government has taken several measures to strengthen SACCOs, including training cooperative leaders, conducting regular audits, and putting in place modern systems to safeguard members’ funds through digital solutions.

“We want every citizen, whether in a village or a city, to have equal access to trusted financial services. That is how we will deliver inclusive and sustainable development,” the Minister explained.

The plan to establish District SACCOs will continue in the remaining 23 districts, with the goal of launching a nationwide Cooperative Bank once all 30 District SACCOs are in place.

Through this program, Rwanda aims to empower citizens with secure, accessible financial services and to drive economic growth through strong cooperatives that contribute to sustainable national development.

Kinyarwanda

Kinyarwanda

English

English

Swahili

Swahili